Introduction to our Sustainability strategy

A Bit Of History

On 1 September 1838, a group of traders led by James Blyth, established ‘La Banque Commerciale de Maurice’, the country’s second bank. The organisation operated through a Royal Charter granted by Queen Victoria that was renewed every 20 years until 1955, when it became a limited liability company.

The Bank’s first 100 years severely tested its resilience – several national financial crises, fierce competition from other commercial banks that had since been established, two world wars as well as various natural disasters. Notwithstanding these difficulties, the Bank managed to expand its activities and considerably increase its capital by 1920. Its activities remained intrinsically linked to the development of Mauritius; emerging sectors such as agriculture, trade and industry became pillars of the economy with the support of MCB.

As the country’s needs grew and diversified following Independence in 1968, so did the Bank’s commitment. It played a pivotal role in the creation and development of a number of sectors, then considered to be risky, such as tourism, textile, local manufacturing, freeport activities, information and communication technology (ICT) and seafood.

In the early 1990s, the Group decided to expand beyond Mauritius, an inspired move that is bearing fruit today. The brand is now present in different forms (banks, associates, representative offices) in Madagascar, the Maldives, the Seychelles, Reunion, Mayotte and Paris (France), Maputo (Mozambique), Johannesburg (South Africa), Dubai (UAE) and Nairobi (Kenya). Moreover, the Group is actively involved in project and trade financing in various sub-Saharan countries, while maintaining a presence in other markets. MCB Group today also provides outsourcing services and is involved in consulting and card processing activities.

The Mauritian Context & Challenges

Being rooted in Mauritius, the Group’s banking activities are intrinsically linked to its home country’s development. As one of the most substantial private institutions of the country, MCB has an important role to play in the development of Mauritius into a prosperous nation. This means that the challenges faced by the country and its population are also the challenges faced by MCB. We therefore seek to make a difference by considering these challenges as business opportunities.

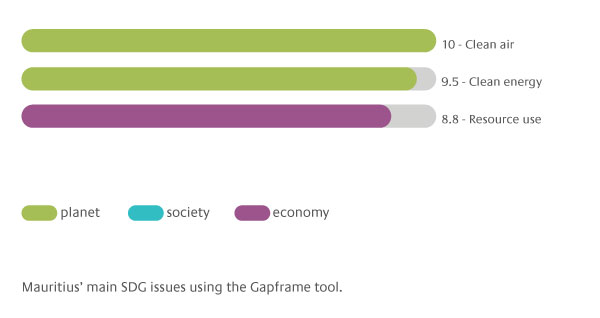

Prioritising Issues using the Gapframe Analysis

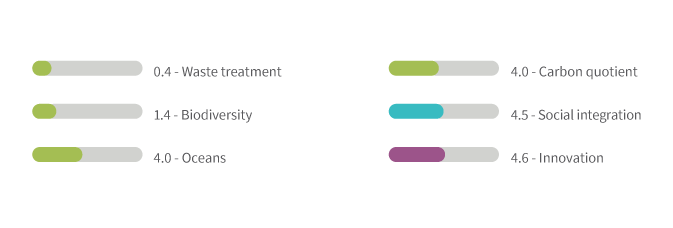

The United Nations Sustainable Development Goals (SDGs) is a useful tool to help identify Mauritius’ sustainability assets and concerns. Since MCB has a critical role to play in strengthening sustainable opportunities and fill the most critical needs at the local level, we have used the Gapframe analysis to contextualise the most important sustainability issues of the country. These issues, as highlighted by this study carried out by international experts, have then been used to feed our materiality analysis.

Mauritius’ main SDG issues using the Gapframe tool.

Corporate Social Responsibility (CSR) was introduced in the Income Tax Act 2009 and required that profitable businesses either donate 2% of their book profits to CSR activities under approved programmes following published guidelines or that they transfer these funds to Government to be used for poverty alleviation. The 2016/2017 budget amended this law to provide that businesses contribute at least 50% of their CSR funds to the National Social Inclusion Foundation (NSIF) – previously National CSR Foundation – which is the central body to receive and allocate public funds to NGOs. Further amendments have now brought this figure to 75% as at January 2019. An exception was made for CSR programmes that were already underway as at January 2019 and which respect the guidelines set by the NSIF; those companies were allowed, subject to approval by the foundation, to retain an additional 25% of their CSR budget.

Introducing our material issues

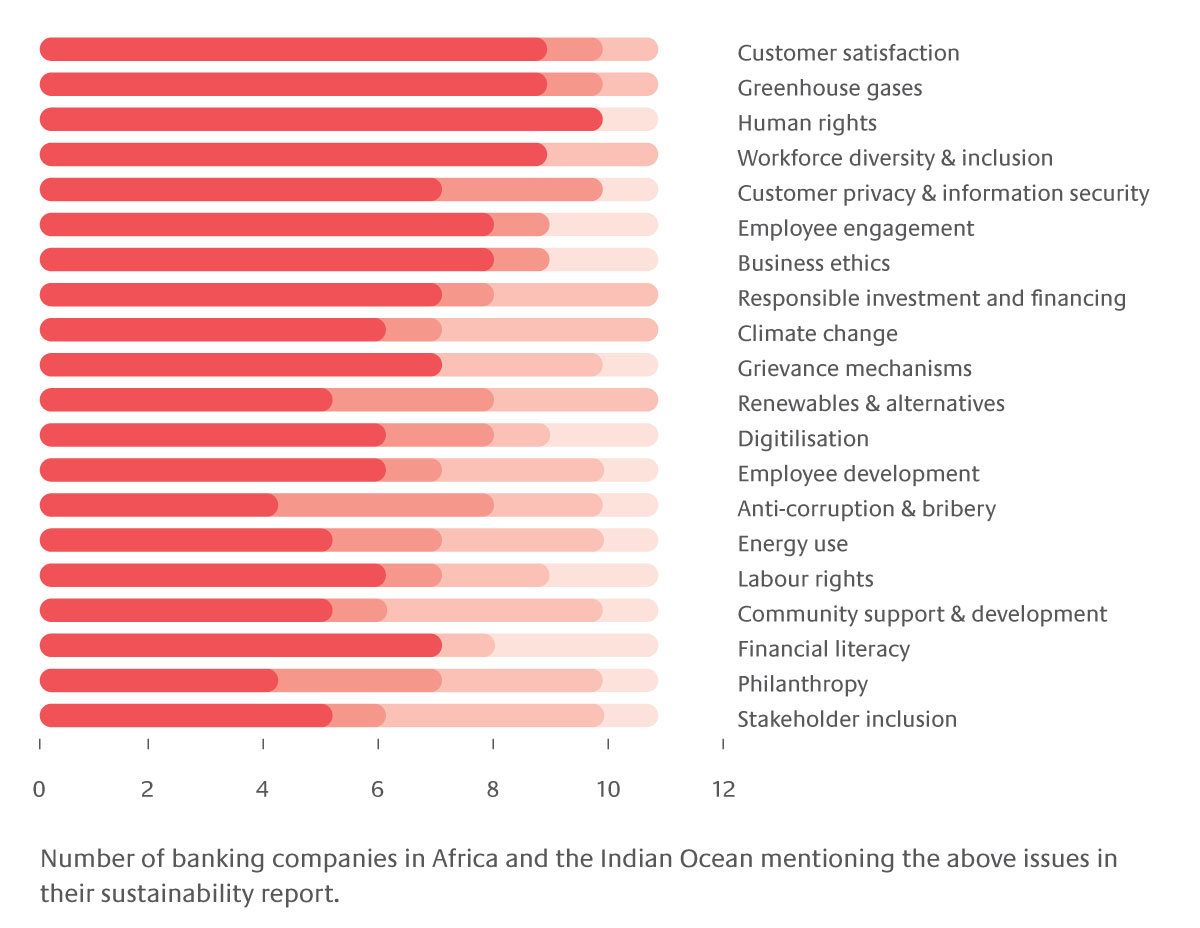

MCB’s material issues can be identified by taking into account both its economic and geographical specificities as well as issues faced by the banking sector globally. This year, we conducted an external materiality analysis crossing by using information from:

- The above-mentioned Gapframe analysis which translates the SDGs into national priorities for Mauritius; and

- The Datamaran3 Artificial Intelligence (AI) powered analysis, which highlights the most salient regional and sectoral sustainability issues tackled by peers of MCB in their sustainability reports as detailed below.

Main sustainability issues mentioned in reports by African and Indian Ocean Banks by Datamaran IA, 2018

3 Datamaran is a software solution for non-financial risk management. The software tracks 100 non-financial topics by sifting and analysing millions of data points from publicly available sources, including corporate reports (financial, sustainability reports as well as SEC filings), mandatory regulations and voluntary initiatives, as well as news and social media.

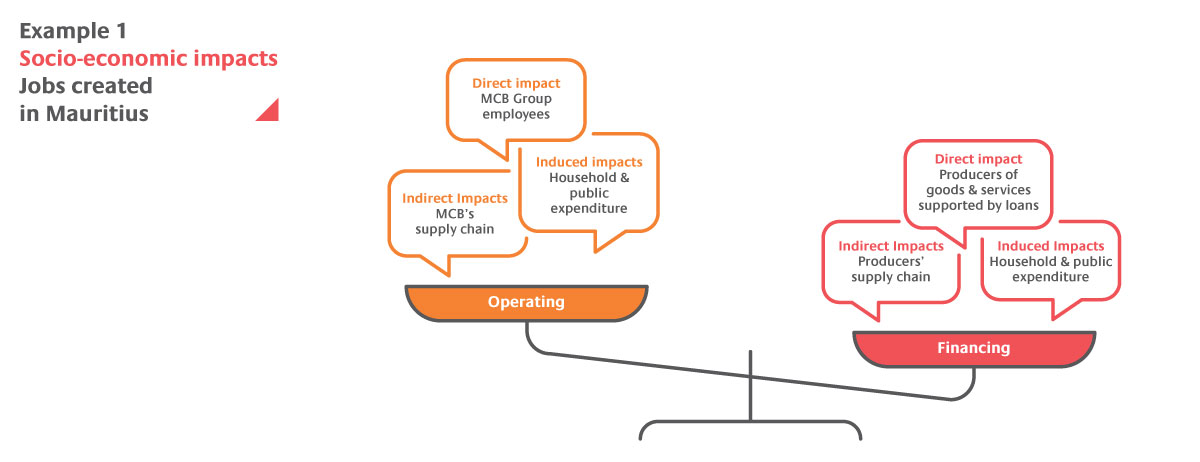

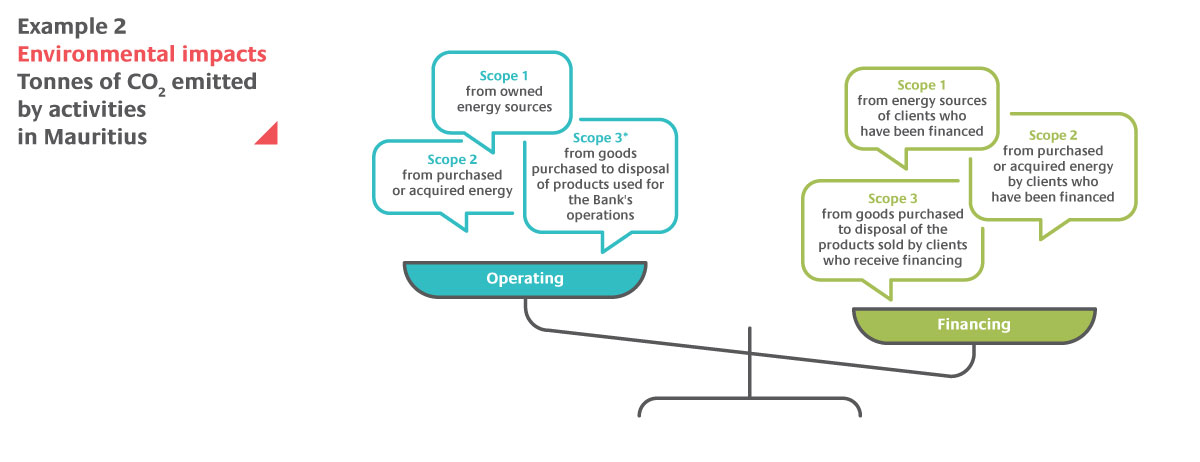

Direct and indirect impacts

On almost every material sustainability issue, the Group has a direct impact through its daily operations, and an indirect one through the financial services and products it designs and provides to its clients. The indirect impacts relating to products and financing represent the bulk of its economic and environmental impact and as such, the main levers for positive impact.

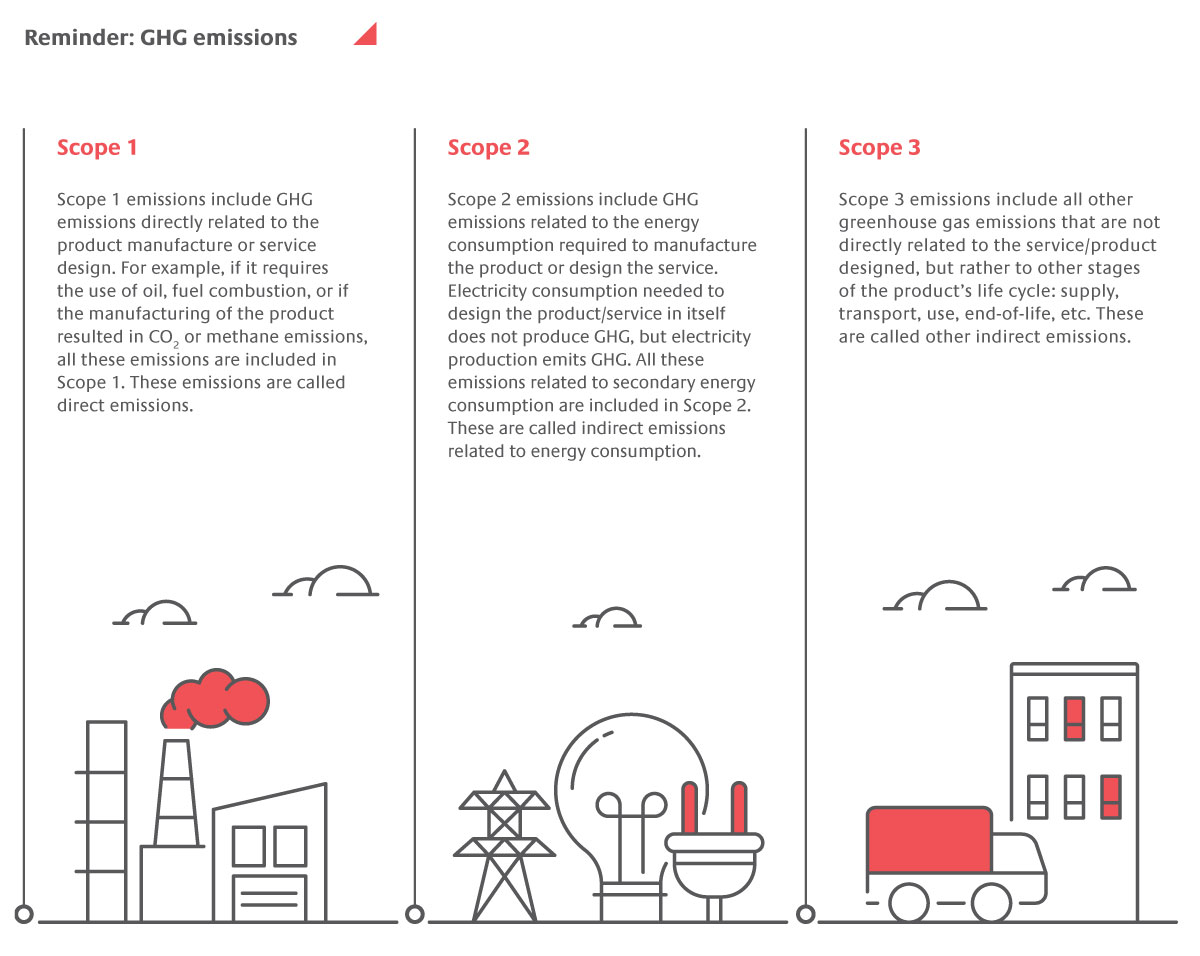

From both an economic and environmental point of view, the impacts of a bank’s day-to-day operations are much lower than the impacts from its projects and client financing. Banks finance all types of companies through loans and investments. The companies that receive financing use the money for expansion and development that in turn, create direct jobs in the value chain or indirect ones through taxation and spending by households. It ultimately also contributes to greenhouse gas emissions. All of those impacts are called financing impacts.

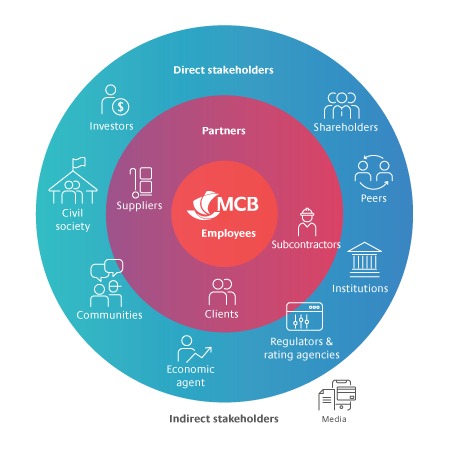

Stakeholder engagement

To limit its negative impacts and maximise its positive contribution to society, a company must build a strong relation to its ecosystem and the various stakeholder groups that influence its activities. Engaging with them to better understand their needs and expectations is one of the foundations of a robust sustainable development approach. The chart below, together with the table opposite, highlight the main stakeholders of the Group, their expectations and how we engage with them in a concrete way.

MCB Group Stakeholder Map

Stakeholders

Main expectations identified

MCB Group's main engagement tools/approaches

Example

Clients

- Provide products that meet their needs as well as quality customer service and experience.

- Provide transparent and timely advice and information on our offering.

- Ensure an effective process for transaction supported by appealing digital solutions.

- Ensure security and privacy of client information and uphold their trust in the organisation.

- The Group constantly surveys its customers on their needs and expectations and regularly gathers feedback on products and services.

- Clients are provided with easy-to-use digital platforms for access to banking services and information.

- The Group leverages its network of branches for face-to-face banking transactions.

- The Group regularly communicates on social media and collects customer feedback.

- Customer lab, customer surveys and focus groups as a co-creation for products and services.

- Digital Factory, branches & kiosks.

- Internet Banking facilities, Mobile Banking App JUICE, MCB websites).

- MCB’s Facebook, YouTube, Instagram, Twitter.

Employees

- Improve the skills, knowledge and experience of employees.

- Foster staff welfare, health, safety and well-being as well as promote inclusiveness and diversity.

- Provide optimum working conditions and attractive remuneration

- The Group monitors employee satisfaction via engagement surveys and gathers employee feedback via discussion platforms.

- The Group provides appropriate and motivating remuneration as well as additional financial and non-financial staff benefits.

- Employees have access to learning and development platforms as well as various training sessions.

- Culture Audit, Feedback sessions, Workplace polls, MCB Restaurants, MCB Staff banking facilities, Counselling.

- Social activities: social leave, plogging.

- Sports activities.

- Training and development portfolio.

Suppliers and

Subcontractors

- Promote the transition towards more sustainable enterprises through engagement with suppliers and contractors.

- Have a clear approach to procurement in line with best practice in terms of governance, human rights and environment imperatives.

- Ensure on-time payments

- Annual surveys are conducted and the Group strives to continuously improve its procurement practices.

- Partnerships and support are established to upskill suppliers.

- A strict supplier selection process is followed.

- Procurement policy.

- Procurement audits.

- Supplier engagement.

Shareholders and

Investors

- Generate adequate earnings and maintain attractive returns on investment.

- Provide timely, and valuable information on the positioning and performance of the Group.

- Preserve the credit ratings of MCB and facilitate access to global financial markets.

- Be aware of global trends and ensure that business decisions are made in consideration of the global environmental context (sociopolitical, environmental, demographic, economic and regulatory).

- The Group promotes open and transparent communication with shareholders to ensure that they receive adequate information while upholding trustworthy relations with them.

- The Group maintains ongoing dialogue with shareholders to discuss its strategy, financial performance and other topical issues and ensures that they are kept abreast of all material business developments in a timely and transparent manner through various communication channels.

- Annual Meeting of Shareholders.

- Group’s website provides for an adapted and comprehensive self-service interface in addition to official press announcements, occasional press conferences.

- Earnings Calls.

- Analyst Meetings.

- International road shows.

- Conference calls and meetings with investors.

Regulators and

Rating Agencies

- Ensure strict compliance with relevant regulatory limits and stipulations relating to business operations, product development, market development, risk management, etc.

- Help preserve the stability and security of the financial sector of countries where we are present.

- Reports are submitted in a timely manner to regulatory bodies, while transparent and open relationships are forged to promote adequate monitoring of activities and pave the way for informed discussions about relevant issues and matters.

- The Group strives to maintain and improve the ratings provided by financial rating agencies.

- Involvement through the MBA.

- Reports sent to and meetings held periodically with the Bank of Mauritius.

- Assessments by credit rating agencies, e.g. Moody’s.

Institutions and

Economic Agents

- Contribute to foster the inclusive socioeconomic development of the country and help to position it as an international financial centre.

- Finance key projects shaping the economic landscape and contribute to thought leadership on key aspects of economic development.

- Regular meetings are held with multilateral organisations and overseas financial institutions, with insights provided on the positioning of the organisation and the operating context of countries in which business is conducted.

- Dedicated insights and reviews with respect to the market and economic environment are provided to enable external parties to better comprehend our positioning and performance.

- Discussions on topical issues of significance to the Group are conducted – notably upcoming legislations and regulations – towards finding out ways to ensure that developments taking place are in our long-term mutual interest.

- Involvement with economic agents: MBA, Business Mauritius, Association of Mauritian Manufacturers, Economic Development Board, MCCI.

- Publications: MCB Focus, 'Lokal is Beautiful' report.

Societies,

Communities

and Civil Society

Organisation

- Promote sustainable socioeconomic development and continue to live up to our engagement as a socially responsible and caring corporate entity.

- Foster well-being and progress of societies in which we operate.

- Value and preserve our cultural heritage and promote arts.

- Adopt environmentally-friendly practices.

- Encourage the adoption of sustainable habits.

- The Group implements and monitors initiatives that contribute positively to the communities in which it operates.

- The Group sponsors or sets up initiatives to contribute to the promotion of arts in its countries of operation.

- The Group strives to reduce its direct environmental footprint.

- Sports and educational activities regularly receive sponsorships.

- MCB Forward Foundation: Football Academy, Cité Tole etc.

- VIBE Moris® by MCB and Rises Nou Kiltir.

- Recycling at MCB, Reduction of plastic in restaurants, energy efficiency measures and production of renewable energy.

- Team MCB, MCB Foundation Scholarship, Chess in School, SEMYIA.

'Success Beyond Numbers'

Sustainability is not new to the Groupth. Over the last decade, several key sustainability milestones were reached. Of note, was Initiative 175, launched in 2009 on the occasion of MCB Group’s 175th anniversary. This environmental action plan consisted of a series of concrete measures aimed at preserving the environment. In 2011, MCB opened its new eco-friendly offices in St Jean. The building boasts improved energy efficiency and hosts a rainwater recycling system.

-

Dec 2007

Signature of the United Nations Global Compact -

Mar 2009

Launch of initiative 175, an ensemble of concerted, sustained and multiple actions in favour of the energy savings, the environment and renewable energy -

Sept 2009

MCB engages in Sustainability reporting (measuring and disclosing performance under various sustainability headings) -

Oct 2009

Signing of first line of green credit from AFD – National line of EUR 40 m -

Sept 2010

Launch of MCB Forward Foundation to manage the CSR activities of the Bank -

May 2012

Adoption of the Equator Principles governing the Bank's Environmental & Social Policy in support of responsible financing -

Oct 2013

Signing AFDB USD 120m -

Feb 2014

Signing of second line of green credit from AFD – National line of EUR 60 m -

Sept 2015

MCB Group ranks in the Top 3 performers of the Stock Exchange of Mauritius Sustainability Index (SEMSI) -

June 2016

Adoption of International Integrated Reporting Framework for our Annual Report -

July 2016

Launch of MCB Microfinance -

Sept 2018

Signing of third line of green credit from AFD – EUR 75 m -

Nov 2018

Launch of 'Success Beyond Numbers' sustainability Vision and Manifesto

In 2017, the Group decided to go a step further in integrating sustainability to its business strategy and brand positioning. Consultations and workshops (led by French consultancy firm Utopies) were held with some 150 employees and executives, as well as external stakeholders. This culminated in MCB Group’s corporate sustainability programme, ‘Success Beyond Numbers’, launched in November 2018. ‘Success Beyond Numbers’ defines the Group’s philosophy and makes a statement about what its stands for and what it would like its legacy to be. This philosophy has three pillars – local economy, cultural and environmental heritage and individual and collective well-being – and is supported by sound and responsible behaviour and governance that together translate the strategy into reality.

This new definition of the Group’s purpose comes at a time when society is increasingly looking to companies, both public and private, to address pressing social, environmental and economic issues. The reasoning behind the strategy is the conviction that as a financial institution that has played a critical role in the economic development of Mauritius, MCB Group has a responsibility to contribute to the nation’s success otherwise than by conventional means. That is why the Group has redefined the way it measures success. Because it takes more than numbers.

‘Success Beyond Numbers’ is more than a tagline or a marketing campaign: it has become MCB Group’s compass to navigate the complex landscape of our times, it is the Group’s fundamental reason for being – creating value every day for its stakeholders and helping make a difference for Mauritius and its people.

‘Success Beyond Numbers’ aims at unifying management, employees, and communities around a common goal that will guide daily behaviours and ethics, providing a framework for consistent decision-making and ultimately sustaining long-term financial returns for its shareholders.

‘Success Beyond Numbers’ is a long-term journey. The launch of the Corporate Sustainability Programme was followed by various initiatives. The Group is currently working on a detailed roadmap with deadlines and quantitative targets so as to ensure measurable progress and a structured approach on all three pillars, in line with our three-year strategic plan. The current plan ends in 2020 while the next one will cover the 2020-2023 period.

Redefining success; MCB’s corporate sustainability programme was unveiled to staff in October 2018 at the Swami Vivekananda Convention Centre.

The MCB Group’s Manifesto

We are MCB, we have grown and prospered

with our country and its people

We are proud contributors to our economic success story.

But how do we define true success...

Is happiness measured by the size of a home?

Or the love it allows a family to share?

Does the value of a car live in its size?

Or in the freedom to choose our own path?

Does the wealth of a business lie in its profit margins?

Or the well-being it provides?

Now is the time to redefine the way we measure success.

Success is access to health, education and jobs for all.

Protecting our environment for future generations.

Empowering business, big small, old and new

Success is equality being everyone’s utmost priority.

We believe in Success.

Success for this land. For all people. For tomorrow.

SUCCESS BEYOND NUMBERS

Earned media

≈ Rs 100k

+280k people reached

+17k interactions

10k likes

youtube

125k views

+90k spectators

79% audience retention

Most viewed video on MCB Group's Youtube Channel

The architecture of MCB’s Corporate Sustainability Programme

‘Success Beyond Numbers’: A positive reaction from our stakeholders

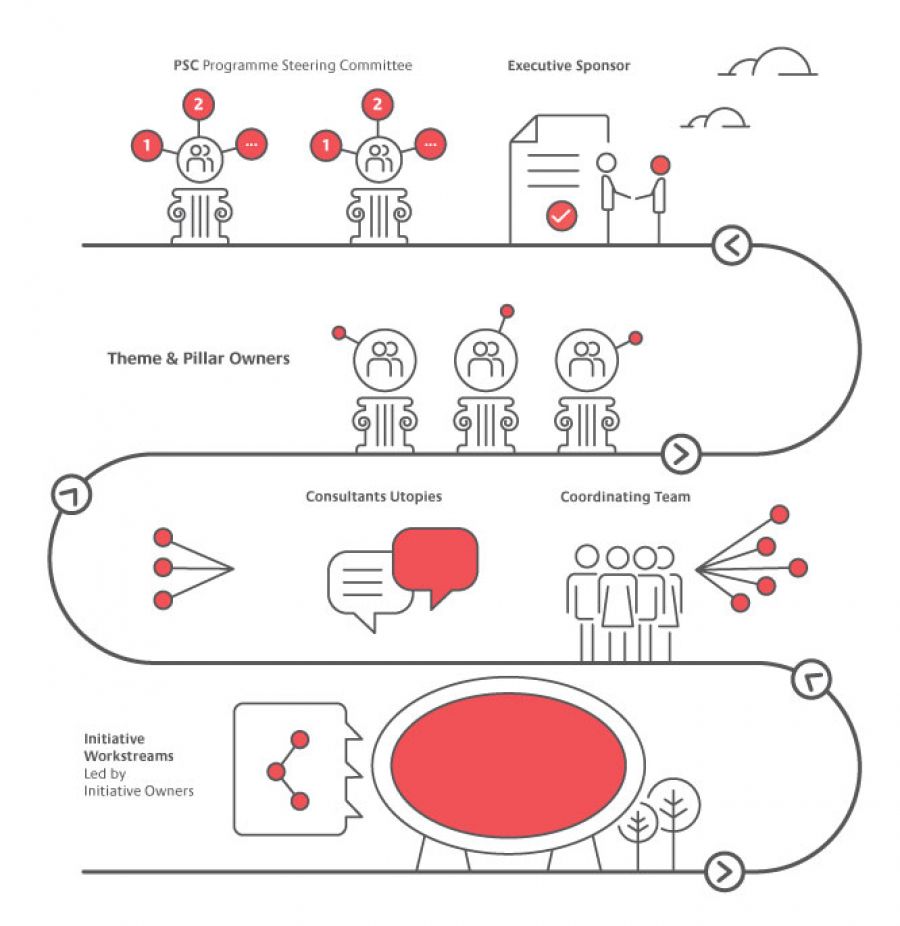

'Success Beyond Numbers' governance

The Programme Steering Committee (PSC) meets on an ad-hoc basis to set priorities, provide advice, bridge appropriate connections and approve objectives, budget and scope. Each pillar has been assigned to a specific PSC member and pillar owners are accountable for the success of their respective pillars.

The PSC is chaired by the Executive Sponsor who has overall authority for the project. He is in charge of tracking the benefits and managing internal and external communication.

The Sustainability Pillar Owners/Theme Owners act as ambassadors for the project inside the organisation. They have set objectives and timeframes, and are in charge of prioritising and scoping the projects for each pillar. There are two experts per pillar and they provide business understanding of the organisation. They identify impact, interdependencies and coordination across the programme.

The Coordinating Team is in charge of project planning, coordination and execution. Composed of different business lines (Strategy, Research and Development (SRD), Marketing and Communication, Human Resource (HR), CEO Office), it manages priorities and resources, as well as the associated risks of the project. It regularly reviews progress of the ‘Success Beyond Numbers’ programme with the help of external sustainability consultants.

The Initiative Workstreams are different cross-functional teams within MCB Group, responsible for the planning and implementation of assigned work stream projects. They ensure that the activities are aligned with the overall programme’s strategic direction.

A dedicated Sustainability Team is currently being set up to promote and monitor the implementation of the ‘Success Beyond Numbers’ philosophy across the organisation. This team will enable better integration of sustainability topics in our operations. The first member of the team, the Sustainability Project Lead, was recruited in April 2019. Our sustainability governance is also being amended to ensure seamless communication amongst stakeholders and a smoother process flow in initiatives roll-out.

© 2019 MCB GROUP #Success Beyond Numbers