Investing in local economic development

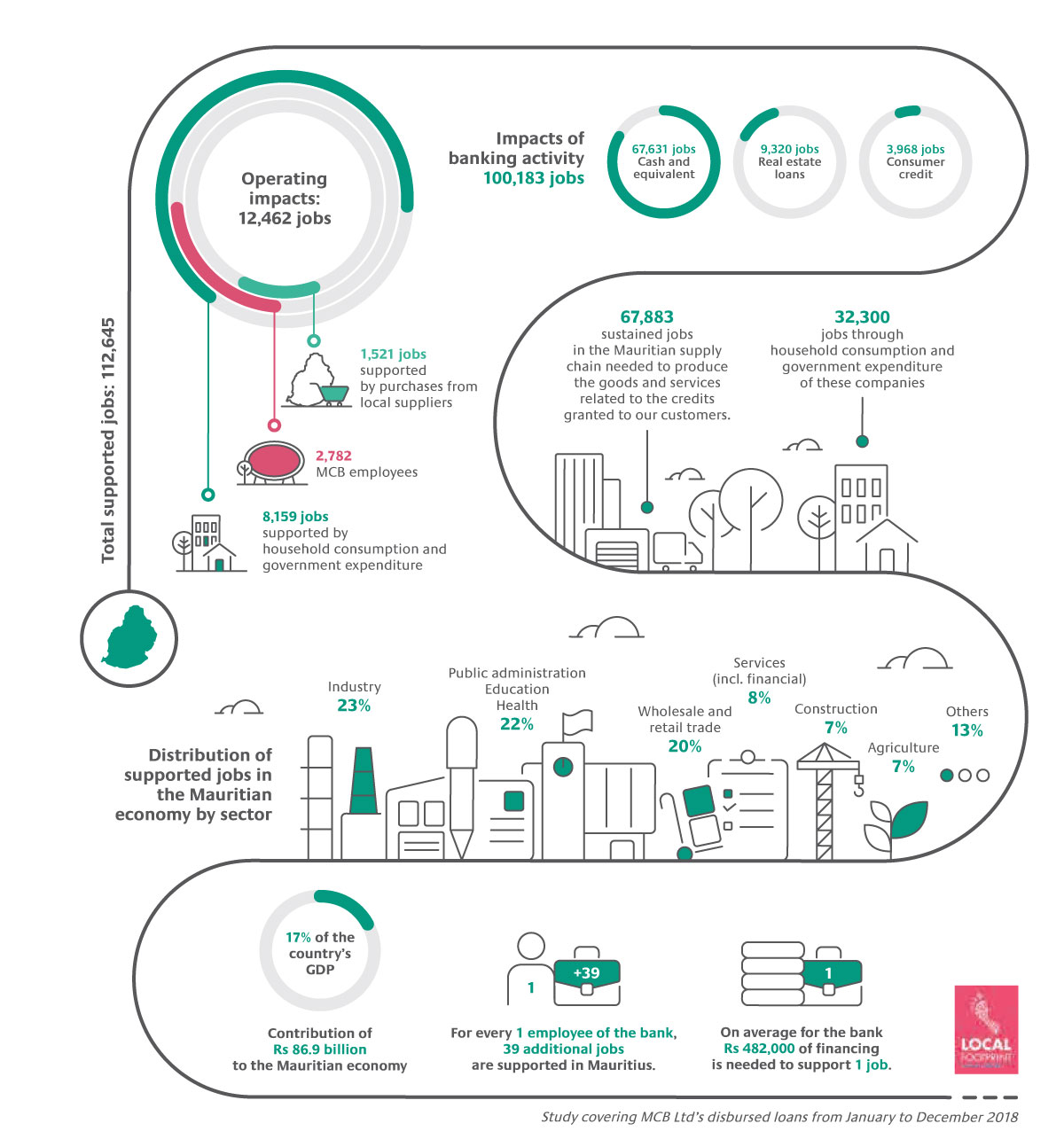

Socio-economic Footprint Of MCB LTD’s Activities4

A company’s contribution to social and economic development is impacted by how socially responsible its policies are. In fact, contribution to socio-economic development is the number one issue that stakeholders throughout the world expect companies to address (34% of respondents vs 15% for environment - Global CSR Study, Cone Communication & Echo, 2017).

As such, an assessement of the Bank’s socioeconomic impact was carried out by the sustainability consulting firm Utopies based on their LOCAL FOOTPRINT® model. This study covers both our direct and indirect impacts on the Mauritian territory for the period January to December 2018.

Direct impacts linked to our own operations

Our direct socio-economic impacts relate to all the jobs sustained and the economic value generated (GDP) in the Mauritian economy via our purchases from local suppliers, the local consumption of our employees and suppliers’ employees (via the wages they receive), and via all the taxes we/our suppliers pay and which support public spending.

Indirect impacts linked to our banking activity

Thanks to the savings entrusted by our clients, the loans we disbursed support the production of goods and services, as well as household consumption and government spending. This also supports jobs and value creation in Mauritius.

For this first edition of the study, overdrafts, investments and bonds were not included in the scope of the evaluation.

In 2018, through its operations and banking activity, MCB Ltd supported nearly 112,645 jobs in the Mauritian economy, representing 18% of the active population5. Our financing activities (via loans) represent 89% of the employment impacts while the remaning 11% relate to our direct impacts.

The socio-economic benefits in the “Industry” sector are supported by loans that finance the cash flow of these companies.

Impacts in the “Public administration, education, health” sector are mainly supported by households’ consumption and public expenditure.

Employment in the “Construction” sector is supported by new real estate loans, renovation loans or via direct purchases from the Bank.

At the same time, MCB Ltd also contributed Rs 86.9 billion to the Mauritian economy, representing 17% of the country’s GDP, through our operations and banking activity. Banking activity represents 76% of the wealth impacts and operations represent 24%.

4 Study covering MCB Ltd’s disbursed loans from January to December 2018

5 Statistics Mauritius Dashboard 2019

© 2019 MCB GROUP #Success Beyond Numbers