Investing in local economic development

Lokal Is Beautiful :

The Rationale Behind The First Pillar

MCB Group has supported entrepreneurship and innovation in Mauritius for over 180 years and as a result, has the necessary power to influence ways to achieve increased prosperity for individuals, Small and Medium Enterprises (SMEs), corporations and the country. But the landscape is no longer the same. Global challenges such as the economic crisis and global warming, added to the digital revolution have sparked a deep questioning of commonly held definitions of prosperity and progress, both at the individual and the collective levels....

Socio-Economic Footprint of MCB Ltd's Activities

A company’s contribution to social and economic development is impacted by how socially responsible its policies are. In fact, contribution to socio-economic development is the number one issue that stakeholders throughout the world expect companies to address (34% of respondents vs 15% for environment - Global CSR Study, Cone Communication & Echo, 2017).

As such, an assessement of the Bank’s socioeconomic impact was carried out by the sustainability consulting firm Utopies based on their LOCAL FOOTPRINT® model. This study covers both our direct and indirect impacts on the Mauritian territory for the period January to December 2018.

Tax Responsibility

Why Tax Responsibility is a major issue for the Group

One of the ways a business contributes to society and local prosperity is by paying taxes. Taxes – be it corporate tax or property tax – provide essential public revenues for governments to meet economic and social objectives.

The 2008 financial crisis and recession brought to the forefront the lack of public trust in business and led to much broader speculation about the taxes companies actually pay. This has led to a worldwide call from campaigning groups, NGOs and non-profit organisations for more transparency and regulation with regards to corporate tax.

And yet, this is not an easy subject because a balance needs to be found between value creation, that preserves the ability to reward investor confidence and value distribution, which ensures a fair contribution to local communities. The international and multi-country scope of Group's activities as well as the level of income and fiscal regime of some of the countries of operation make this subject all the more relevant to MCB Group’s social contribution.

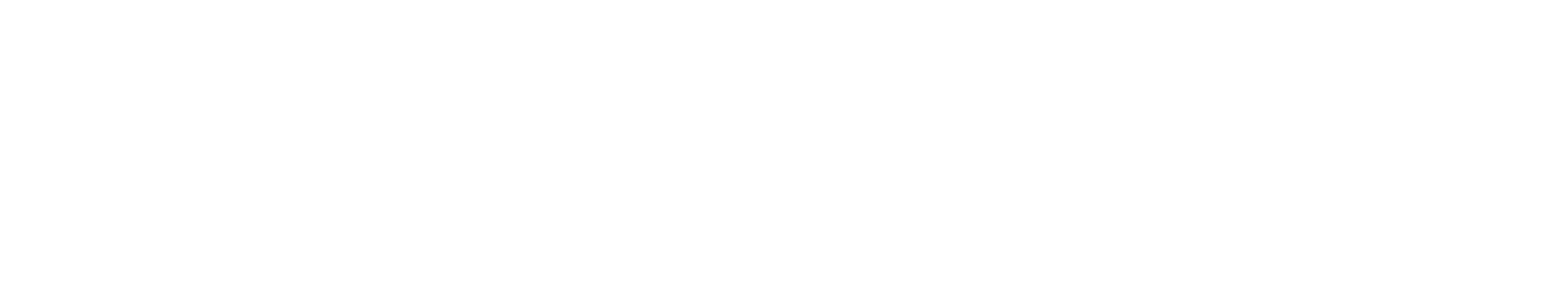

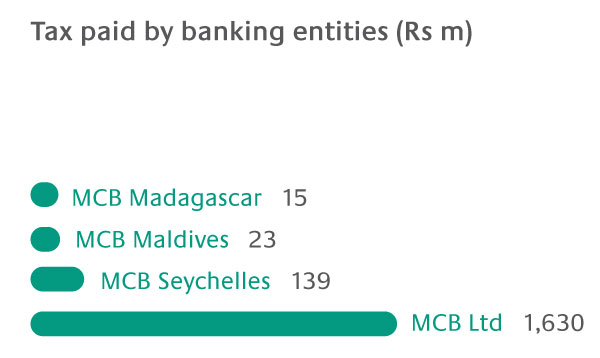

Tax breakdown

Overview of taxes paid by MCB Group banking entities in year ending 30 June 2019

MCB'S credit exposure in non-cooperative tax jurisdictions at as 30 June 2019

*Marshall Islands and United Arab Emirates have been removed from the EU list of non-cooperative jurisdictions in October 2019.

Financial services

Banking cluster

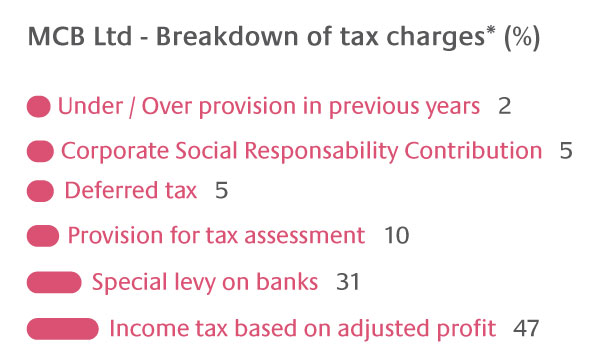

MCB Ltd seeks to widen its footprint across the corporate, institutional and high-net-worth customer segments in sub-Saharan Africa and beyond, by means of customised solutions. It is an active promoter of the Group’s ‘Bank of Banks’ initiative, which consists of providing adapted solutions to financial counterparts, thus leveraging its local experience. To further its development, the Bank leverages its representative offices in Johannesburg, Paris, Nairobi and Dubai and a network of around 1,150 correspondent banks worldwide, including some 200 in Africa. Beyond, the Group’s foreign banking subsidiaries in Madagascar, Maldives and Seychelles and its overseas associates, i.e. Société Générale Moçambique and Banque Française Commerciale Océan Indien (BFCOI) – operating in Réunion Island, Mayotte and Paris – provide clients with banking solutions that are adapted to the realities of local markets, while capitalising on synergies within the Group. Corporate and Institutional Banking activities include different financial services provided internationally by MCB:

- Financial institutions: MCB offers support systems, back office or loans to African and European institutional banks

- Energy and Commodities (E&C): MCB finances mainly the trading of oil and gas, and provides term funding to Exploration and Production oil companies, with a strong focus on African transactions

- Corporate international: MCB offers its products and services to multinational companies

- Local corporates:

- MCB helps Mauritian clients diversify and invest abroad

- MCB supports multinationals that plan to settle in Mauritius by financing their business base, treasury funds…

MCB Group

Non-banking financial cluster

MCB Capital Markets Ltd is the investment banking and asset management arm of MCB Group.

MCB Factors Ltd is a prominent operator in the field of factoring in Mauritius.

MCB Leasing Ltd offers a wide range of finance and operating leasing solutions.

MCB Microfinance provides dedicated financial support to micro and small entrepreneurs

Other Investments cluster

International Card Processing Services Ltd (ICPS Ltd) provides state-of-the-art technology in Switching and Card Management Systems.

MCB Consulting Services Ltd provides companies with sustainable solutions to help them attain their innovation and business development goals.

Fincorp Investment Ltd is an investment company with diversified interests.

MCB Institute of Finance Ltd provides students and professionals with financial knowledge via dedicated courses.

Breakdown of international revenues of the Bank

*Others include treasury, retail banking, cards issuing, management fees, dividends and fair value gains.

Lobbying

MCB Group has historically favoured a neutral approach in terms of public policy. However, its position as the dominant bank – with over one million bank accounts in Mauritius – and its new corporate sustainability programme, are making neutrality a non sequitur as it forces the Bank to question its role and its socio-economic impact on the development of Mauritius. As a member of the Mauritius Bankers Association (MBA) and in line with the association’s priorities, MCB believes that financial literacy is one of its biggest responsibility towards its clients. As the leading bank in Mauritius, with its results directly impacted by the country’s economic performance, MCB believes it has the responsibility to influence economic growth to achieve sustainable prosperity.

Procurement practices

Procurement is another key corporate lever for having a positive impact on the local economy and on sustainable development. In line with its strategy, MCB favours as far as possible, suppliers whose goods are of a certain quality and whose practices comply with its environmental and social standards.

With regards to its procurement practices, MCB aims to have a demonstrable impact on the environment and society, while reducing risks and encouraging suppliers and employees alike to share its standards in view of staying in a virtuous cycle of continuous improvement.

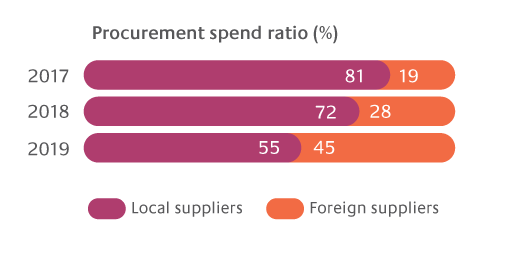

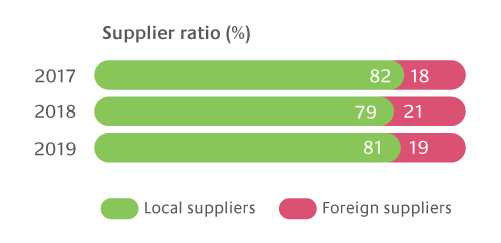

In line with the above, MCB, as a signatory to the UN Global Compact (UNGC), favours suppliers who respect the ten principles promoting human rights, fair labour practices, environmental protection and the fight against corruption. The Bank also has a procurement charter in place that defines responsible procurement as the consideration for the social and environmental aspects of the products purchased as well as the supplier’s attitude towards sustainable development. On top of that, local suppliers are encouraged to provide evidence of their quality assurance programme, health and safety programme, and their code of ethics via a specific supplier information sheet. Most of our suppliers are local companies. However, the procurement spend ratio has seen a recent increase in favour of foreign suppliers, mainly due to contracts with foreign consultants and companies having specific expertise not found locally.

MCB intends to adapt its procurement model to the circular economy concept and some projects in line with the latter are already underway.

Breakdown of our spend volume and suppliers by type

Microfinance

Mauritius is a country where access to loans remains problematic for SMEs and is even more complex for micro-businesses. As part of MCB Group’s pledge to foster the financial inclusion and empowerment of small entrepreneurs, MCB Microfinance Ltd was launched in July 2016 as a wholly-owned subsidiary of MCB Group Ltd, and the first microfinance institution in Mauritius. Its aim is to facilitate access to business loans for micro-enterprises and self-employed individuals. Clients have access to two types of micro-loans:

Micro-loan Working Capital to help meet working capital needs such as purchase of raw materials or stock. The repayment period for these loans ranges from six to 18 months

Micro-loan Investment for capital spending requirements of businesses such as extensions. The repayment period ranges from 12 to 60 months

Next Steps

MCB seeks to promote the development of the local economy by stimulating responsible entrepreneurship. As such, the Bank launched the Lokal is Beautiful (LIB) Scheme on 19 August 2019. The latter has been designed solely for SMEs (having a turnover between Rs 2m and Rs 50m) and aims to provide funding to a larger number of entrepreneurs at a lower rate if they are ready to adopt good practices, and thus build businesses with a positive impact. The scheme is also more flexible than the more traditional schemes aimed at SMEs, in terms of loan security and the sector they operate in. Flexibility is key in this particular segment because it allows for the creation of new economic models based on novel and often untested ideas.

A dedicated SME platform is currently in preparation. This platform will enable SMEs to find all the relevant services, information, products and contacts with one aim to help them surf through the complicated landscape of entrepreneurship in a changing marketplace. This ecosystem for SMEs will be made available to MCB and non-MCB entrepreneurs in the coming months. MCB will tap into its consequential database, leverage its partnerships with different entities and institutions to better accompany SMEs and help them grow.

© 2019 MCB GROUP #Success Beyond Numbers