MCB Group At A Glance

MCB Group At A Glance

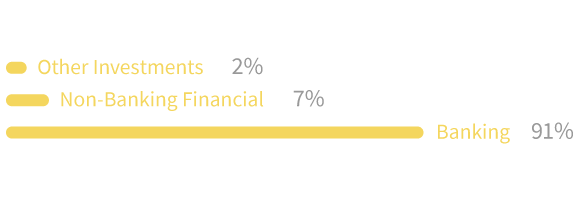

MCB Group Limited (denoted as ‘MCB Group Ltd’ or ‘Group’) is the ultimate holding company of the Group. The subsidiaries and associates of the Group operate under three clusters, i.e. ‘Banking’, ‘Non-banking financial’, and ‘Other investments’. The Group’s main subsidiary, the Mauritius Commercial Bank Limited (denoted as ‘MCB Ltd’, ‘MCB’ or ‘Bank’) is the leading bank in Mauritius. The Group is also a prominent financial services provider in the region.

Now Doing Business

60 Branches and Kiosks

Staff

Assets

Client base

Market Capitalisation

Shareholders

20,426

MCB Group operating income* by cluster - Rs 21.1 bn

*Figures displayed are prior to the eliminations of inter-company transactions.

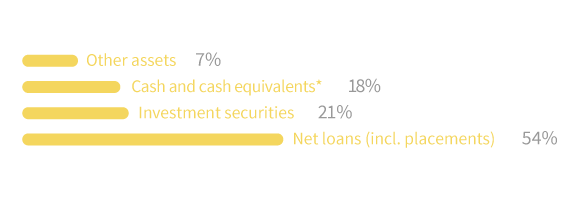

MCB Group asset mix - Rs 471.2 bn

* Including mandatory balances and placements.

Some perspective...

As mentioned earlier, the MCB Group is both an important local player – via its main subsidiary MCB Ltd, the longest standing bank in Mauritius – and a provider of financial and non-financial services in the Indian Ocean region and Africa.

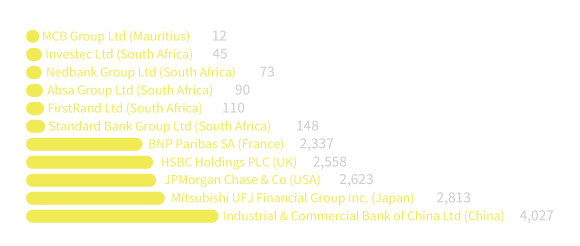

In the worldwide banking industry however, the Group remains a relatively small player. As such, our Corporate Sustainability measures will be much more impactful at the local and regional level than internationally.

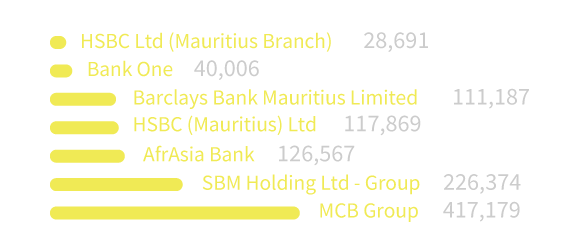

MCB Group’s relative size - Local peers

Total assets in Rs m as at 31 December 2018

Source: Annual reports of respective companies

MCB Group’s relative size - Regional & international peers

Total assets in USD bn as at 31 December 2018

Source: S&P Global Market Intelligence, 2019

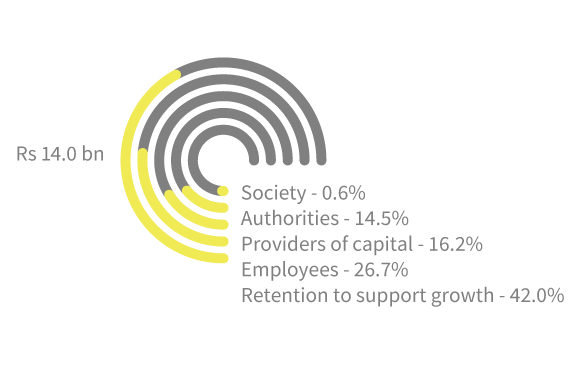

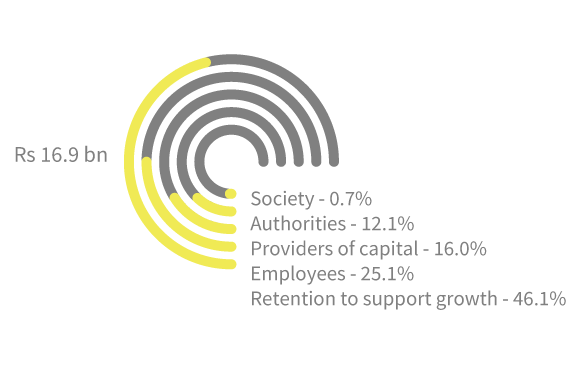

Value Distribution

There is perception and then there is reality. The perception is that banks get rich through interests paid by their clients. The truth is that the Group seeks to help its clients prosper, irrespective of who they are, and creates value for its stakeholders. MCB Group's banking activities remain its core business and they generate financial flows for its stakeholders who have the legitimate expectation that the Group will deliver.

The following charts describe how value is generated by the Group and shared among its stakeholders.

Evolution of wealth created by the Group

FY2017-2018

FY2018-2019

Retention to support growth

Employees

Providers of capital

Authorities

Society

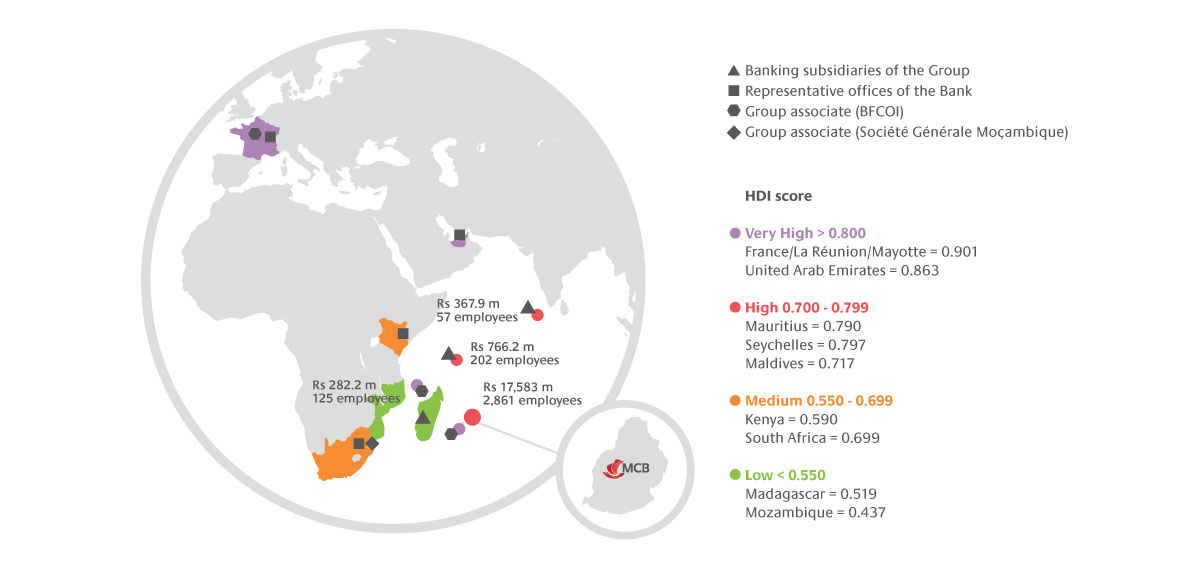

Where We Operate

Headquartered in Mauritius where its main subsidiary operates, the Group has a notable presence in the Indian Ocean region and sub-Saharan Africa through its three foreign subsidiaries, two foreign associates and four foreign representative offices. While MCB Group’s banking activities contribute to the economic growth of the countries where it operates, it has had to reckon with substantial environmental or social issues faced by some of them.

In order to better understand and overcome those challenges, locally adapted approaches were taken in the respective countries. This allowed for a more inclusive contribution encompassing economic growth and socio-economic development. Individual and collective well-being as well as environmental conservation and/or cultural resilience are also part of the focus.

The chart below maps our countries of operation against their most important sustainability issues as defined under the Gapframe1 analysis and the Human Development Index2. These internationally recognised tools provide useful information on the sustainability context of the countries in which we do business.

1 The Gapframe analysis translates the Sustainable Development Goals (SDGs) into relevant issues and priorities for all nations, adding and amending aspects where needed (http://gapframe.org/). It was developed by a Swiss cross-sector initiative called the Swiss Sustainability Hub (SSH), which includes government & non-government institutions such as the WBCSD, WWF, IISD, Swiss Environmental Agency, universities and business schools, as well as companies like Swisscom, Migros, Unilever and IKEA.

2 The Human Development Index (HDI) is a tool developed by the United Nations to measure and rank countries’ levels of social and economic development. The index combines four major indicators: life expectancy, mean and expected years of schooling, and Gross National Income per capita.

© 2019 MCB GROUP #Success Beyond Numbers